Edited to add: Yes I think my maize yields are high, and I suspect it has something to do with the way I structured the model years ago (see discussion below). I always try to make few/no changes to the model during the season, but switching to % deviations at the end of the year will be investigated, depending on how this one turns out. The August report from the USDA has an error predicting final yields with a standard deviation of over 6 bu/ac, and doesn't really close on the final number until the October report. This year the September number may be better given the early harvest going on.

I'm going to try to cover a few topics today with one post as I've had little time in the evening this week to get posts together. So I'd like to talk about some simple observations of the RIN markets that I hope you will scrutinize and criticize, tell you why I think I'm wrong about the corn yield and then give you my predictions anyway.

What are the RIN markets telling us or maybe I don't speak the language?

First let me start out by saying I don't clearly understand the 2013 RIN prices and what these represent. I'm trying to figure out if these are forward quotes or some other specification. I'll make some comments on them but these are entirely contingent on them being forwarded RINs of some type. If anybody has clarification please let me know.

Conventional RINs

2011 = $0.01

2012 = $0.05

2013 = $0.08

In looking at conventional RINs, I think they suggest several things. With respect to the mandate either 1) the low price suggests the mandate isn't all that binding and removing it might not have the large effect some might thing (See Irwin and Good

here ) and/or the RIN prices include some probability that a waiver will come and devalue existing RINs. I would suspect it is a combination of the two.

The 2013 value jumps another few cents, reflecting the drought and risk premium, and perhaps even a bit of a tightening blend wall. When I look at maize and oil prices in the futures market, maize prices are down (which would be negative for RIN prices) and oil prices are flat (higher oil prices should lower RIN prices). So this suggests it is either risk or the blend wall, at least to me.

A back of the envelope calculation might suggest taking the RIN price, multiplying it times the number of gallons per bushel of corn and calculating how much the mandate is supporting the price of corn, overly simplistic? Probably for the reason it might reflect expectations of a waiver already, but it is my starting point

Advanced RINs

2011 = $0.49

2012 = $0.49

2013 = $0.51

Advanced RINs are mostly flat all the way out, reflecting, perhaps, adequate sugar markets. I would argue the RINs give a good approximation to relative prices of ethanol in US and Brazilian markets and tell us all else equal (which it never is!) how much maize prices would have to rise with mandates in place until imports would start displacing maize ethanol in the overall mandate.

First we might expect that

Brazil ethanol price + $0.30 for transport - US maize ethanol price - conventional RIN = Advanced RIN

using round numbers for the day these RINs (a day or two old)

$2.85 + $0.30 - $2.65 - $0.05 = $0.45 So in the ball park for expectations.

Again, how much could corn rise all else constant before sugarcane ethanol and maize ethanol come into competition? (again the 2.8 is gallons of ethanol per bushel)

(advanced RIN - Conventional RIN)*2.8 = (0.49-0.05)*2.8 or about $1.23. Yes we are importing now and faster than last year, but we also have a 490 million gallon advanced mandate gap to plug in 2012, 3 times the size of last years.

Biodiesel RINs

2011 = $1.08

2012 = $1.10

2013 = $ 1.23

For biodiesel, this tells me it is a long way from helping to fill the advanced gap by producing beyond its mandate. Keep in mind if you want to try the simple calculation to the price of soybean oil that the biodiesel mandate is on physical gallons but it produces 1.5 RINs per physical gallon. This should also tell you something about the expected production effects of a re-instatement of the biodiesel blenders credit!

Feel free to beat me up about this string of pure conjecture!

On to crop yields and production.

Corn Yield: 139.2 bu/ac

Corn Production: 11,930 million bushels

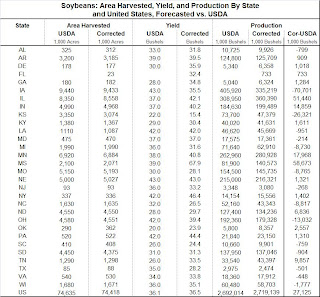

Soybean Yield: 36.3 bu/ac

Soybean Production: 2,706 million bushels

Cotton Yield: 814 lbs/ac

Cotton Production 17.697 million bales

Here is where I paper up my excuses for being wrong on Friday! The graph just below is a illustration (not real model results) of what I mean when I said the model uses absolute vs percent deviations and how that is likely to effect the result. In the model the difference between a poor acre and an very poor acre is a fixed number of bushels, over time this becomes a smaller and smaller percentage of overall yields, thus it implies that the maize crop is better (substantially better) at dealing with abiotic stresses such as drought. This year has certainly called that into question. An alternative specification might use percentages in each class so the same conditions in 1988 would give you a similar percent deviation from the trend line and thus a MUCH lower maize yield than I currently have. I had hoped to run some of this analysis this week but as you can see, I've run out of time.

I'm clearly above the trade estimates for maize, but I'm below the trade estimates for soybeans, or at least at the bottom end of the range. For cotton I dropped nearly 1 billion bales this week in production but I'm probably still well above the trade estimates for production and yields.